Make Money Online

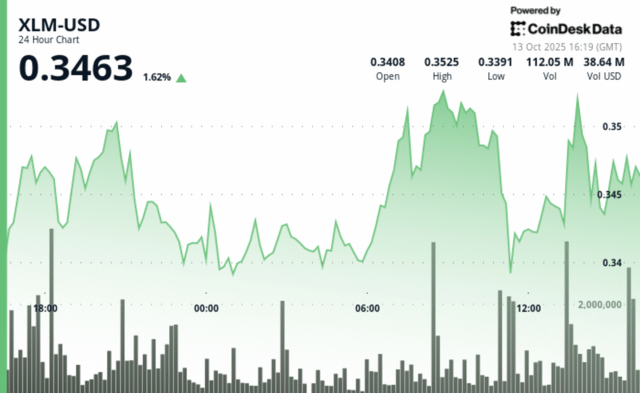

Make Money Online Stellar posts dramatic intraday recovery from $0.33 support to $0.35 resistance as institutional money flows in.

Updated Oct 13, 2025, 4:32 p.m. Published Oct 13, 2025, 4:32 p.m.

Market Recovery: XLM Leads with 6% Daily Gain

Stellar’s XLM surged 6% over the past 24 hours, closing at $0.35 after weathering bouts of volatility. The asset traded within a $0.02 range between $0.33 and $0.35, briefly dipping to $0.34 before buyers regained control. The recovery underscores growing bullish sentiment across major crypto assets following October’s selloff.

Institutional Buying Signals

The final hour of trading showcased strong institutional accumulation. XLM opened at $0.35 before slipping to $0.34 by 13:29. In a sharp three-minute rally from 13:31 to 13:33, bulls propelled prices back to $0.35 on a surge of 15 million tokens traded — a move technical analysts read as a hallmark of institutional participation.

Technical Picture and Macro Context

XLM’s performance mirrors broader crypto resilience despite persistent macroeconomic headwinds. Analysts point to wave-4 support holding firm, validating a bullish continuation pattern. Veteran trader Peter Brandt reiterated confidence in top digital assets, calling recent market weakness a “temporary shakeout” within an intact uptrend.

Outlook

Resistance remains at $0.35, where selling pressure continues to emerge, while support has solidified near the same level — suggesting a coiling setup. With hourly gains of 1% into session close and volume-backed accumulation, XLM appears poised to extend its recovery momentum in the near term.

Technical Indicators Summary

- Key support zone emerges at $0.34-$0.34 where buyers consistently step in.

- Resistance builds at $0.35-$0.35 level where selling pressure intensifies.

- Volume patterns show institutional participation at critical inflection points, 24-hour average of 37.5 million sets benchmark.

- Strong resistance holds at $0.35 where sellers consistently emerge in final session.

- Support consolidates near $0.35, creating tight range in final 30-minute window.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

Cathie Wood’s ARK Invest Takes 11.5% Stake in Solana Treasury Firm Solmate Infrastructure (SLMT)

Ark Invest has reportedly taken a 11.5% Solmate (SLMT) stake while the company said it bought $50 million discounted SOL from Solana Foundation.

What to know:

- Solmate (SLMT) says a Schedule 13G filing shows ARK Invest owns approximately 11.5% of the shares as of Sept. 30, 2025.

- The company also says it bought $50 million worth of SOL from the Solana Foundation at a 15% discount.